KEY TAKEAWAYS:

- Eighty-five percent of successful business owners work with financial advisors—but 79 percent have hired less-than-capable advisors, while 74 percent are concerned about being exploited by advisors.

- You must avoid both the Pretenders (advisors with good intentions but limited skills) and the Predators (advisors who want to exploit you).

- Action step: Work with an elite wealth manager who is intensely focused on addressing your needs and wants, and offers solutions beyond just investments, which are used by the Super Rich and ultra-wealthy business owners.

As a successful business owner, you almost certainly get help with your finances. But are you getting the right help—the quality of advice that will allow you to achieve your biggest, most important goals in life?

The answer, very likely, is “no.”

Here’s why—and what you can do about it, starting right now.

The advice problem

Nearly 85 percent of successful entrepreneurs with at least $1 million in financial assets work with financial advisors to help them manage that wealth.

That’s absolutely the right move. Think about it: You want to spend your time, expertise and energy where you generate your wealth—your business—and not trying to become an ace investor and wealth manager. Relying on talented financial professionals just makes good financial sense.

But there is a big problem.

Most successful business owners are NOT getting the highest-quality advice that they need to maximize their ability to attain the level of serious wealth they seek.

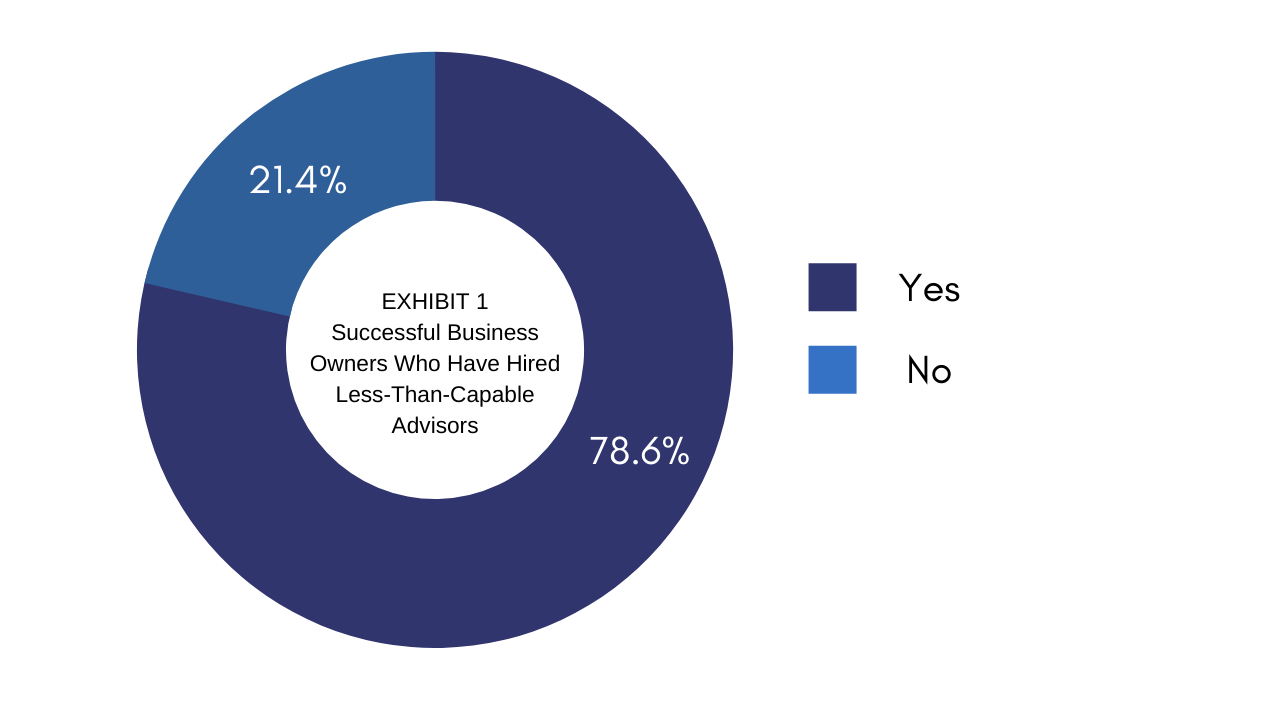

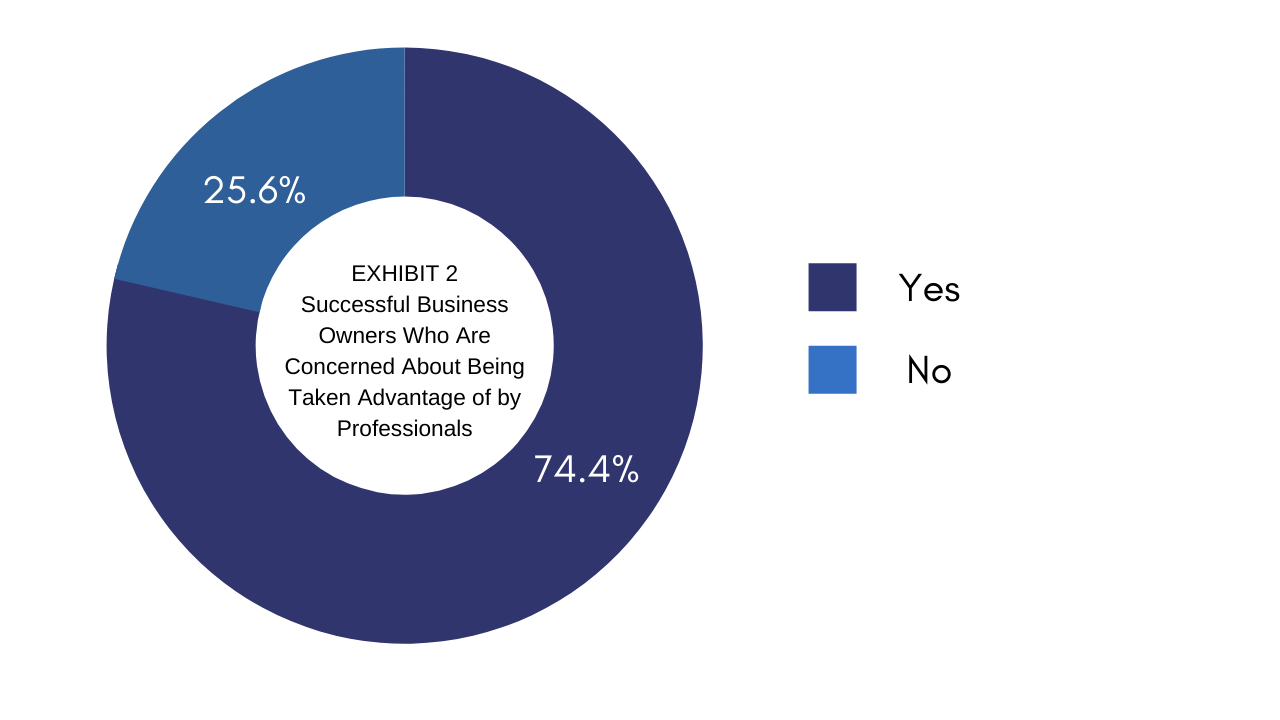

Nearly four out of five successful business owners have hired less-than-capable advisors. At the same time, almost three-quarters of these entrepreneurs are legitimately concerned about advisors taking advantage of them.

Three reasons you may be working with the wrong advisors

The fact is, the vast majority of financial advisors (and other professionals like accountants, attorneys and bankers) currently serving top business owners like you simply aren’t familiar with—and don’t offer—many of the advanced, top-tier wealth management solutions that you need to achieve tremendous personal financial success.

IMPORTANT: That doesn’t mean these advisors aren’t good at their jobs. But it does mean they may not be ideal for you. Your continued success and the goals you are striving for may mean you have outgrown your current financial advisors, and they just can’t bring value to your financial situation anymore.

There are three common reasons why so many advisors serving business owners lack the ability to help their clients build serious wealth.

- They don’t know about Super Rich solutions for success. Some financial advisors simply aren’t aware of the elite-level planning tools and techniques that guide the financial decision-making of the Super Rich (people with a net worth of $500 million or more), of ultra-wealthy business owners and of family offices.

- They don’t know how to use Super Rich solutions. More commonly, financial advisors are familiar with some of the wealth management strategies and products used by the Super Rich, by ultra-wealthy business owners and by family offices. But knowing something exists and knowing how to adroitly use it to help clients are two very different things.

- They don’t work proactively with other professionals to implement Super Rich solutions effectively. Financial advisors who do not have relationships with the right teams of experts find it difficult, if not impossible, to implement Super Rich solutions—so they end up ignoring them when making recommendations.

Avoid these two types of advisors at all costs

Many accomplished business owners tell us that they recognize they have outgrown their current financial advisors. But they don’t really know where to go to find guidance that is ideally suited to them—and they don’t have the time or energy to go on the hunt.

The good news: Finding the right help doesn’t have to be an endeavor.

Start by knowing the traps to avoid. One of the biggest obstacles you face is working with either of two types of advisors you want to avoid at all costs: Pretenders and Predators.

- Pretenders are advisors who do not serve their clients well due to incompetence, or who have good intentions but limited expertise. They may want to do a sensational job for their clients, but they are just not capable. According to successful business owners like you, there are a lot of Pretenders out there (see Exhibit 1).

- Predators, in contrast, are intent on financially exploiting people. A whole range of Predators look to manipulate other people—particularly accomplished, affluent individuals and their families. There is no mistaking Predators—but many times that recognition comes only in hindsight.

Nearly three-quarters of you are concerned about being taken advantage of by the professionals you work with (see Exhibit 2).

You need an elite wealth manager

So how do you avoid Pretenders and Predators—and find the type of financial guidance that will truly position you to excel?

Ultimately, you should probably be seeking an elite wealth manager. These professionals are fundamentally different from the investment advisors and financial advisors that business owners typically work with.

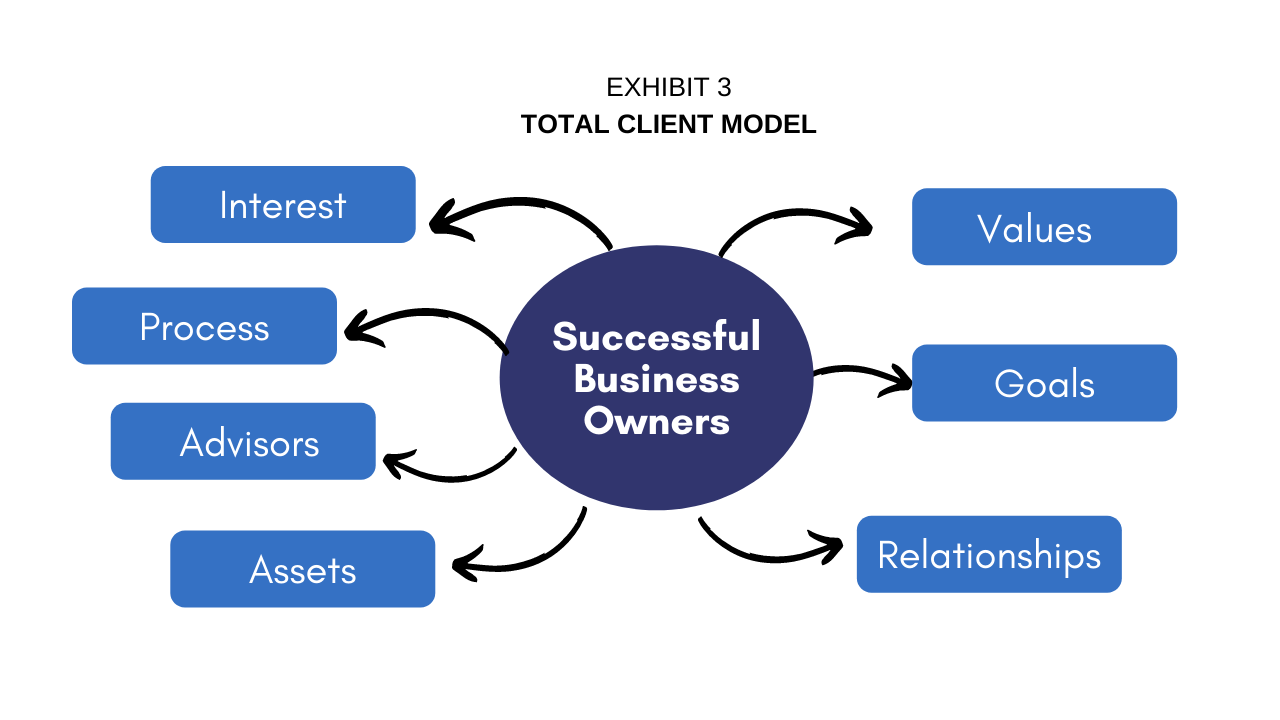

The biggest difference: Elite wealth managers take a truly holistic financial approach to helping their business owner clients. This requires a comprehensive client evaluation process that puts you at the center—surrounded by the seven key characteristics that make up who you are and what you value

Elite wealth managers offer investment management, of course. But they also go far beyond it by providing sophisticated planning capabilities in areas such as:

- Increasing the value of your business

- Mitigating your taxes

- Taking care of your heirs

- Protecting your assets from litigation and divorce

Magnifying your charitable giving

Elite wealth managers are better equipped to provide Super Rich solutions, which meet three

criteria:

- They are frequently implemented by the ultra-wealthy, including very successful business owners, the Super Rich and many family offices.

- They can also be used by many business owners seeking affluence to help themselves become seriously wealthy.

- They can be implemented only by elite wealth managers in conjunction with their teamsof high-caliber specialists.

IMPORTANT: Super Rich solutions are not necessarily restricted to the wealthiest among us. They can be applicable for a wide range of individuals, families and business owners, usually once they achieve around $1 million or more in personal financial assets. But, as noted above, relatively few financial professionals truly understand these solutions or can effectively implement them.

How to meet the elite

It’s time to ask yourself a key question: Are you getting the type of help you need—and deserve—from your current advisor or advisors?

- Does your advisor offer state-of-the-art solutions to address your entire financial situation? Or is he or she more of a glorified order-taker focused only on investments?

- What kind of results has your advisor delivered? Does your advisor meet your expectations and your needs based on where you want to go financially?

- Is your advisor proactive—does he or she make you aware of sophisticated solutions that might benefit you, without your having to ask first?

- Do you have a feeling that you might be getting shortchanged by your financial advisor and could find better advice more tailored to you elsewhere?

The commentary presented herein contains the opinions of Lions Wealth Management, Inc., a State of Minnesota Registered Investment Advisor. This information should not be relied upon for tax purposes and is based upon sources believed to be reliable. No guarantee is made to the completeness or accuracy of this information. Lions Wealth Management, Inc. shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes, and therefore are not an offer to buy or sell a security. Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. This information has not been tailored to suit any individual.