Growth Now, Collapse Later?

Are you watching this?

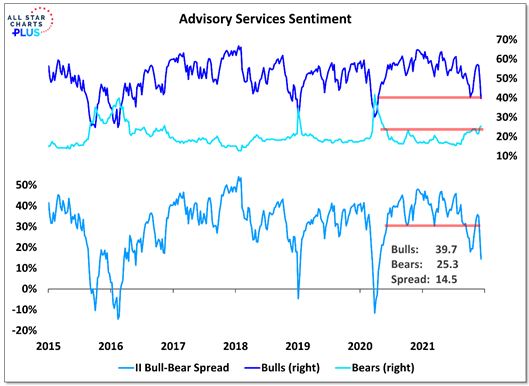

We’re seeing the fewest amount of happy financial advisors since April of 2020, when things were as bad as it gets.

Now here we are just a few pennies from new all-time highs in the S&P500, and the people that are excited about the market are in full retreat. Panic mode has set in:

In this chart you can see the bull-bear spread completely collapsing. Meaning people are pessimistic.

And remember this data represents the Advisory Services. Keep in mind that last week we highlighted what was going on among individual investors – the most amount of pessimism in over a year!

This summer, the excitement was a headwind.

Based on the weight of the evidence, pessimism is now much more of a tailwind.

Do stocks usually fall hard when individual investors and financial advisors are prepared for that?

No. Definitely not.

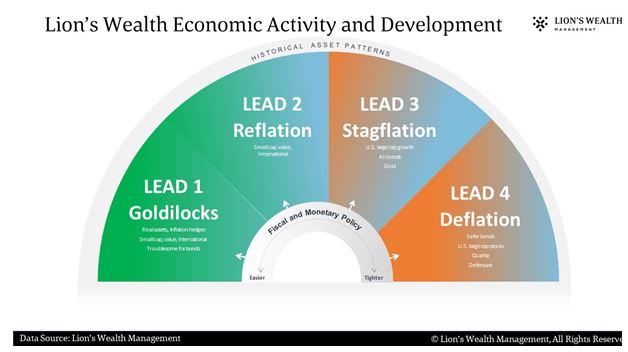

Now, things are changing. We are growing as an economy, but what happens when that stops?

Bad things.

By the second quarter of next year, there is a good likelihood that the economy will go into LEAD 4.

As a reminder, LEAD 4 is when we have:

- Slowing growth

- Deflation or Disinflation

For now, this might be minor (or might not even happen), but if growth slows with our Federal Reserve Chair Jay Powell starting to tighten the money flow, we could see things change faster. We’ll be watching this very closely.

For now, we are in a great place for growth.

This is called a Christmas rally. Merry Christmas.

The commentary presented herein contains the opinions of Lions Wealth Management, Inc., a State of Minnesota Registered Investment Advisor. This information should not be relied upon for tax purposes and is based upon sources believed to be reliable. No guarantee is made to the completeness or accuracy of this information. Lions Wealth Management, Inc. shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes, and therefore are not an offer to buy or sell a security. Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. This information has not been tailored to suit any individual.