Transcript:

With everything that’s going on with this world right now, with stock market, with inflation, with wars, with the economy downturn ,with real estate downturn, with all of these things going on.

How can you make sure that your investment advisor, your wealth advisor, or financial planner, they’re all working towards your benefit. There’s one aspect that you need to be asking of everyone you meet and that one thing is what we’re going to be talking about today.

Welcome back with all the uncertainty right now with respect to the stock market being in this bear market action with real estate downturn happening with hyperinflation with the federal reserve increasing interest rates with war with everything that’s going on you name it there is a lot to do with respect to making sure that your investments are in a risk-managed safer environment.

There’s ways that we want to make sure that you’re going to be set up well for the future if you’re retired we want to make sure that you are being able to take income correctly all of those come back to making sure that you are well taken care of with your wealth plan with your investments and that alone is a big aspect also a part of this video and for you watch it I am going to give you something special a webinar called Retire Happy , where we’re going to be celebrating the key areas of your retirement and how to have confidence going into retirement and the things you want to do now we’re going to be talking about the seven steps for retirement confidence I’m also going to be asking you two key questions that you need to address and answer to have that confidence in your retirement and then the last aspect will be diving into the number one risk of your retirement and how to solve that so those areas are what we’ll be talking about in this webinar now go ahead sign up in the description below for this webinar and I look forward to helping you have the confidence and create an impact with your business your family and your community with your wealth I look forward to seeing you there.

Now when you look at your financial advisor your financial planner your investment advisor your wealth manager it doesn’t matter what title that they have what matters is what they’re doing for you and too many people today are actually just winging it too many advisors are just winging it they don’t have a process in place and that process is what makes sure that they don’t wing it with your financial plan with your way forward and working through this period of time that financial plan that you have been working so hard on over the years well that process also makes sure that they have a process to go through not only well investments to make sure you’re in the correct investments for your level of risk comfort but also that we have a process in place for all the other aspects of your wealth plan so what does that look like well let me share this screen with you here because I want to actually go through what it means to have a process what it means to actually be working on your benefit and going through those details.

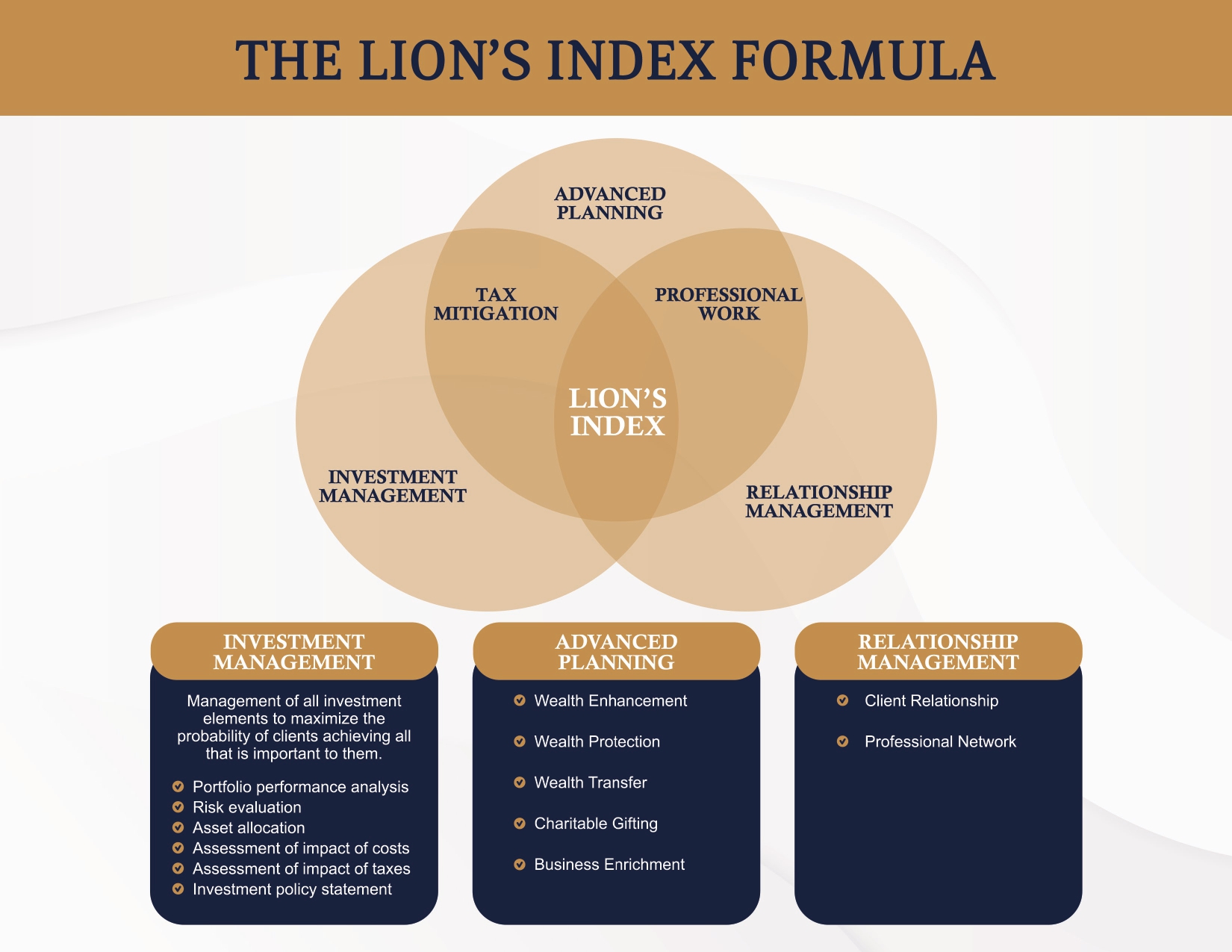

Let’s take a look at the Lion’s Wealth Process here this is what we bring all of our clients all of our family of clients into and I want to share this with you because when you are looking at wealth advisors maybe the one you currently have maybe it’s another one that you’re looking to bring on board and to be helping with your finances well I want you to make sure that they have the process in place that’s going to fit you well.

What is the Lion’s Wealth Process?

This is going to be very helpful for you to understand what you’re wanting from a financial planner from an advisor from a wealth manager well let’s take a look at this all right so first of all when we dive into details here yes, the investment side of things are very important.

You see investments are well they’re obviously one of the most important things when it comes to making sure we have the correct amount of growth if you’re not in the correct investments then a lot of what we’re trying to do with the rest of your wealth can’t happen and why I say that why it can’t happen is because we’re going to be wanting a level of growth to happen we’re going to be wanting a level of well if you’re into products that provide guarantees we’re going to be wanting a level of guarantees if you’re into another aspect of products that are going to provide some income streams we want to make sure we have those income streams so the investments are actually vitally important to your wealth plan.

What we do here at Lion’s Wealth to take a look at the investments we start from what you call the macro environment. We take a look at all the different investments that we could be going into and then we start looking at those in light of where you’re at so are you retired do we need to have some guaranteed income and if you have pensions that’s a guaranteed income, if you have social security that’s a guaranteed income but what about other guaranteed income sources that is definitely something that we need to be looking at especially to make sure that you have the ability to have your income side of things taken care of and they last all of your retirement.

What happens if you’re on the opposite end you have your business that you have created that you’ve started you’re growing well that’s fantastic congratulations what do we do now how do we save correctly into the what types of vehicles so we can go into a 401k we can go into a defined benefit plan we can go into many different aspects whether they’re Roth or traditional type of accounts to make sure that you have everything taken care of for your personal wealth, your family’s wealth, and that you can actually be saving money in the business on taxation as well see we can do all of these things.

But it comes back down to knowing where you’re at and then that comes back down to taking a look at all the different investment vehicles we could go into and start narrowing them down the process of narrowing down comes back to what your needs actually are well that in turn leads us to the second phase then so once we know some of the investments that we’re going to be utilizing that we need that’s not the point of it that’s not the heart of every little aspect of what we need to do now we need to marry those investments with what I call the advanced plan.

The advanced plan here is real is really diving into the details of to every little aspect then that we talked about so it’s not just your income streams but that’s a part of it it’s not just taxation but that’s a part of it, see we can go through all of these different areas and then we can start really diving into details of what’s going to be working the best so when we talk about everything related to the advanced plan and that’s why I want to spend so much time on this the advanced plan.

The wealth enhancement is we are making sure that we have the correct investments in place that’s making sure that we have the tax mitigation in place those types of details we go through wealth protection well that’s making sure then that we have the correct insurances you see right now today with an economic downturn with inflationary at a rate of growth that we haven’t seen in over 40 years with a lot of people that are going through some hardships it’s going to be troublesome for many people and why that’s important to you that others are feeling pain, that others are feeling hardships and you may not be well when desperate people have well needs sometimes they can be desperate and do desperate things including well maybe say rear ending and trying to make it look like it’s your fault.

If you don’t have the correct insurances in place that could come back against your wealth maybe there’s other things that are malicious that uh someone has done to you well having those insurances in place in a time like now is vital to make sure that you have a successful outcome in the future. Now that’s just an example here that’s not going to say it’s going to happen but it’s just an example of why we want to go through wealth protection because desperate people sometimes do desperate things especially when they feel they’re cornered and they don’t have the ability to pay the bills they don’t have the ability to feed their family well that comes back to that wealth protection making sure that we can protect your hard-earned wealth then we have other aspects that we come to that relate everything to well charitable giving well if it’s important to you to be charitable to sustain the organizations that you care about we want to make sure that it is taken care of that we have a plan in place process for doing that.

There’s another aspect that it comes back to now that we have the protection, now we have the taxation taken care of now that we have the wealth enhancement taken care of we want to make sure that your money goes to the intended people at the intended time that’s what I call wealth transfer again we have a process in place go through to make sure that whether we want to transfer today tomorrow, or in the future all of that is what will make sure that your money goes to the correct people like I said at the correct time now you as a business owner you can have a lot of different opportunities like I mentioned already.

We can be talking about how we can be better in your company so that can be well buy sell agreements between ownership we can have employee ownership coming in with a stock ownership plan so now we can bring in multiple employees under the process and it can be an employee owned company well that really drives a lot of uniqueness to the company that drives a lot of growth at times to the company because of the fact you have a lot more people that are engaged in the company okay well that’s a piece of it as well but then what we can also do is say how can we bettering the company bettering the people that you care about while making sure that your family is taken care of so there can be different retirement opportunities and retirement plans that you can be stocking away a lot of money tax deferred, and then you can also be doing that for your employees as well and you get the benefit as the owner so there’s a lot of opportunities that we can go through that comes out with the process that we take you through.

Now that last aspect then is how we can marry the what not only the advanced planning but the investment advice with respect to relationships so not only is it the relationship that we have here at Lion’s Wealth with you as our family of clients but then this is also coming back to the relationships that we have with the other advisors and the other people speaking to your financial well-being so when you take a look at financial advisors, financial planners, investment advisors, you name it doesn’t matter the title making sure that they play nice in sandbox with your CPA, with your accountant, with your estate attorney, with all of the different people that are speaking into your life that is going to set you up for more success than what it would have been if you had just had one person take a look in the investments.

If you had just one person looking at your estate plan when we work together that alone is going to be not the end-all sale but it’s going to be a help it’s going to be putting everything together in the correct manner. Another aspect here this is really the heart of a lot of the planning that we can go through here so let me do this let me pull this up okay so when we actually put the full process together we look at again the investments so we start with that piece of the puzzle here so we have cash accounts, we have joined accounts, we have trust accounts, that you have houses so we put all that together and we can come up with a net worth okay well that’s the piece of it that comes back to all of our facts and we can come into anything related to investment so we have your salary down here we can have social security down here all the social security benefits. We can then put in pensions, so we put all of this together and the first thing that we’re going to realize here would be well the plan so putting that together just putting in how much you need for and basically living expenses how much we need for having fun anything in the future that we need here so what is what would it look like if we wanted to put tithing to your church in here.

What would it look like if we needed to well just to have some money set aside for learning how to play an instrument or travel so making sure that not only are your basic expenses taken care of but we also have a plan in place for the additional as well the fun things that you do that alone part of that process then we can be building it out and saying well what happens if we take social security at different life stages different ages what happens if we defer for you but we maybe take a little bit earlier for your spouse with social security or what happens if we do a Roth Conversion you see all of this really comes back to what’s going to be very beneficial to you what’s going to be beneficial to your family and making sure that we can pass on the assets that we want to. We get a big picture here and we can actually be putting together your financial plan so the financial plan again is just a piece of it though that’s our starting point now we can start diving into details looking at all the goals at one point.

We can look at the income sources that account for it well then we start diving into like I said that wealth transfer and what we can see here is that we have well almost a million dollars of tax that we’re going to be owing because of some of the different ways that we have the assets structured right now so that’s vitally important if we need to have a million dollars paid out to tax is that something you want no okay let’s talk about it so you can see how these all come together and then what we can do here say well we know we need to pay almost a million dollars to tax well maybe let’s take a look at the life insurance so we can take a look at where we’re at today, and yes you can see we have 250,000 dollars is that a million? No, let’s talk about this let’s make sure that we have enough of the wealth protection to take care of in this case taxes so you see it doesn’t always have to come back down to something just like you being sued or making sure that in case you have an accident with your car that we’re being able to fix it in this case.

It can come back down to making sure that taxes are taken care of that we have the correct ways to distribute the assets to your heirs all of that comes back down to the process and then when we bring that in we take a look at taxes we can actually figure out saying yes we’re in the 24 tax bracket this year what about next year so we can make some adjustments to that so we’re paying right now no capital gains tax on long-term capital gains well that’s good knowledge so we can start figuring out do we need to be selling some of the stock this year in anticipation that if we don’t have to pay tax on this for the long term capital gains maybe we can reinvest that we can look into your state tax and then we can actually put it together and we can come down here and we have a lot of different types of planning that we can go through just for your tax so you see when we bring this all together here when we take a look at all the different pieces of your financial puzzle.

That is how we bring the process together the planning side of things to make sure that we’re not missing anything and that’s the key here that we don’t want to miss something that we should have been doing so when we take a look at all the different things that are going on with this world the economy the way it is this bear market that could be ongoing we don’t know but what we do know is that the process will start looking at all of those details and as things come up whether it’s new tax laws as things come up whether it’s new laws from the government of changes that we can keep up with them that we can make those change and those adjustments to your plan and that you can have a well the hope is a better retirement.

The commentary presented herein contains the opinions of Lions Wealth Management, Inc., a State of Minnesota Registered Investment Advisor. This information should not be relied upon for tax purposes and is based upon sources believed to be reliable. No guarantee is made to the completeness or accuracy of this information. Lions Wealth Management, Inc. shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes, and therefore are not an offer to buy or sell a security. Investments in securities are subject to investment risk, including possible loss of principal. Prices of securities may fluctuate from time to time and may even become valueless. This information has not been tailored to suit any individual.